1961 Income Tax Department All Acts Income-tax Act 1961. This is incentives such as exemptions under the provision of paragraph 1273b or subsection 127 3A of ITA 1976 which is claimable as per government gazette.

What Are The Benefits Available For Start Ups Under The Income Tax Act Taxmann Blog

3 of section 172 declaring Substituted for treating by Finance Act 2003 a person to be the representative of a non-resident person or an order under section 221 refusing to rectify the mistake either in full or in part.

. Power to transfer cases-. 283E-In exercise of the powers conferred by clause d and clause e of proviso to clause 5 of section 43 and section 282A read with section 295 of the Income-tax Act 1961 43 of 1961 the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules 1962 namely-. 3 LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Section 107A 109 or 109B. Short title and commencement 2. B 6 23 of the taxpayers income for.

Prior to the omission section 127 sub- section of which was substituted by the Finance No. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the lesser of. 1 Paragraph 1273b of ITA 1967 Exemption given by the Minister of Finance to any class of persons from complying with any provision of the Income Tax Act 1967 either generally or in respect of any income.

C has made a claim for a reinvestment allowance under Schedule 7A. CBDT Notification No. A is a nil if the total of all amounts deducted in the year by the taxpayer in computing income under this Part from farming activities excluding any deductions arising from inventory adjustments under section 28 and from transactions with persons that do not deal at arms length with the taxpayer is less than 25000 and b in any other case the total of all.

A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and. Non-chargeability to tax in respect of offshore business activity 3 C. 6 Nothing in.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified educational expenses. Scope of total income.

Substituted by the Direct Tax Laws Amendment Act 1987 w. Charge of income tax 3 A. Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for.

1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter applies or tax for any previous year of assessment remaining unpaid and those regulations may in particular and without. B is exempt from tax on its income under section 54A paragraph 1273b or subsection 1273A. Section - 3 Previous year defined.

Paragraph 1273b or subsection 1273A of ITA 1967 entitled to be claimed as per the Government gazette or Ministers approval letter. 1- 10- 1975 read as under 127. Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption on statutory income varies between 70 and 100 for a period of 5 to 10 years from the date the first income is generatedThe quantum of exemption available are as follows.

The Income Tax Ordinance 2001 Section. To be considered qualified payments must be made in accordance with an employers written educational assistance plan. History Subsection 1275 is amended by Act 683 of 2007 s29 by deleting the word 108 wherever appearing has effect for the year of assessment 2008 and subsequent years of assessment.

Section 1273b exemptions made under gazette orders Section 1273A exemptions given directly by the Minister of Finance. D has made a claim for deduction in respect of an approved food production project under the Income Tax Deduction for Investment in an Approved Food Production Project Rules. In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976.

Income Tax Act 1967. And b any tax deducted under section 107A 109 or 109B from any such income shall be refunded under section 111. The Income Tax Department NEVER asks for your PIN numbers.

2 Act 1967 w. 6 Nothing in this section shall be so construed as to exempt in the hands of a recipient any income in respect of dividend interest bonus salary or wages paid wholly or in part out of income exempt from tax by virtue of this section unless that first-mentioned income is itself so exempt. 1- 4- 1967 and again the Taxation Laws Amendment Act 1975 w.

Section 10 Of Income Tax Act Exempted Income Under Section 10

Income Tax Case Laws Set Off Carry Forward Of Losses Section 70 To 80 Income Tax Act

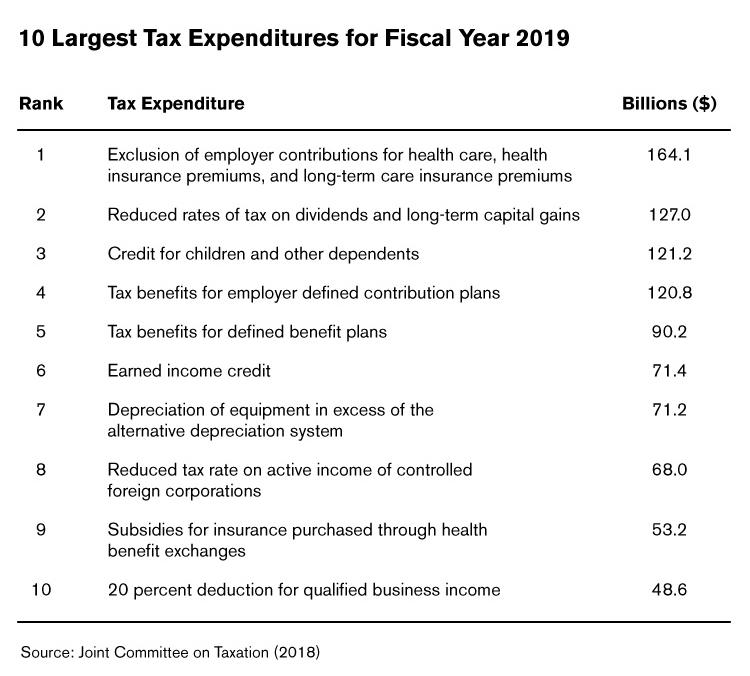

What Are Tax Expenditures And Loopholes

Follow Goods Services Tax S Gstindiacom Latest Tweets Twitter

/LLC1-18d57e4a3ac44dccad4562e536e71cd7.jpg)

Limited Liability Company Llc Definition

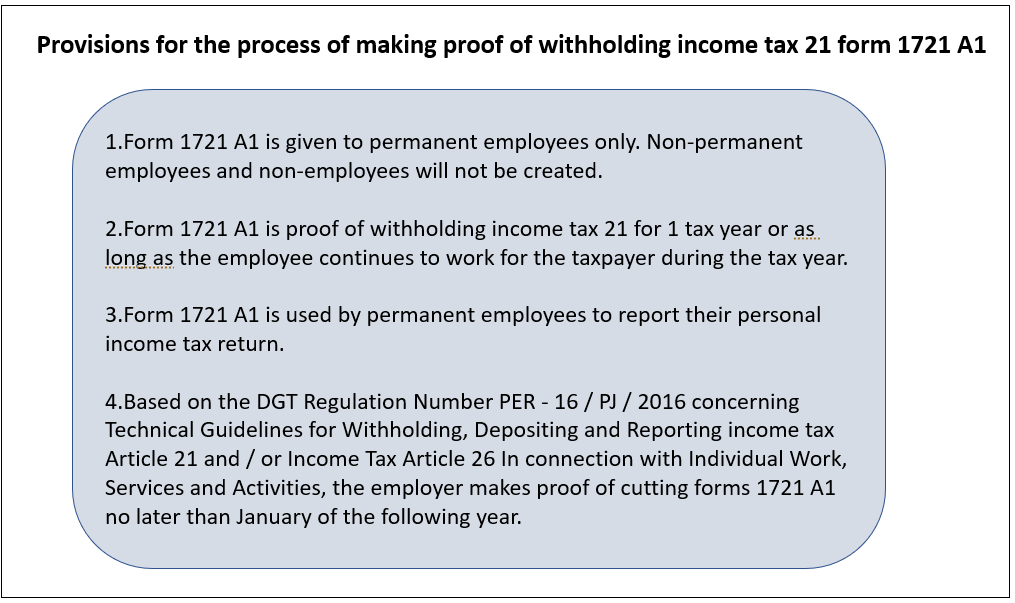

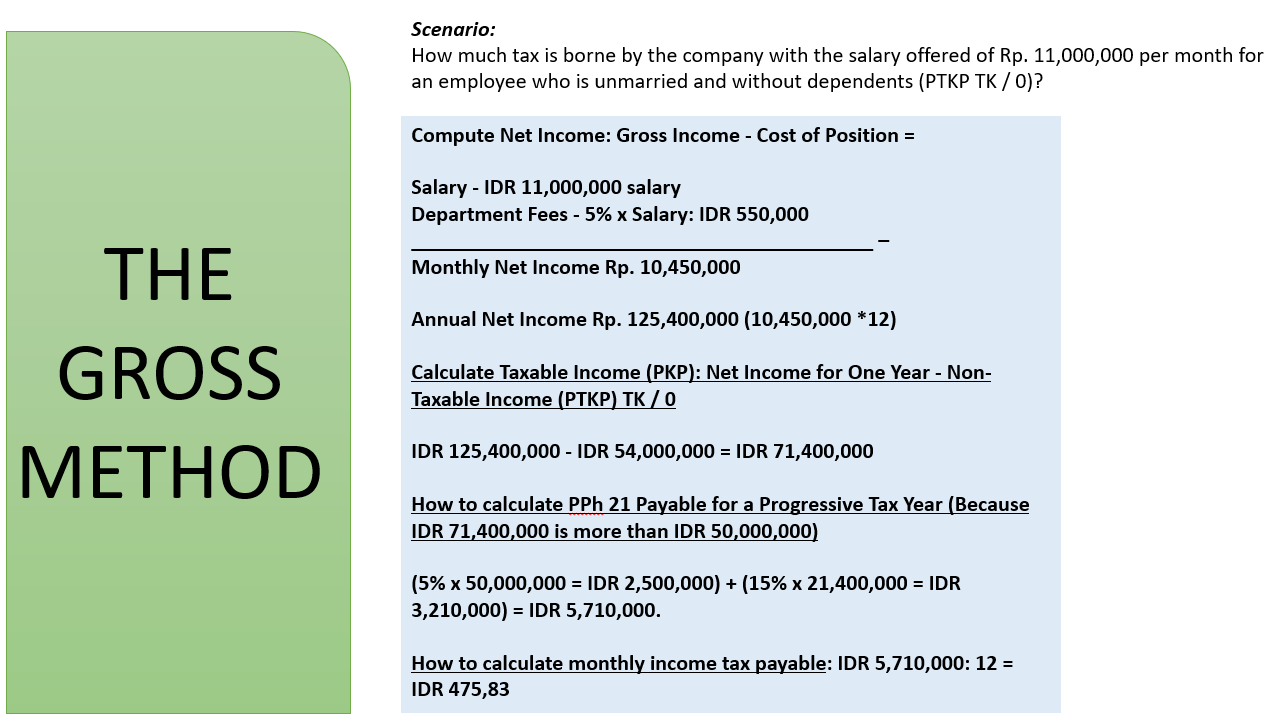

Indonesia Payroll And Tax Guide

Section 282a Of Income Tax Issue Of Income Tax Notice Indiafilings

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

Indonesia Payroll And Tax Guide